Swish

Information on the Swish payment method.

Introduction

Swish is a hugely popular payment method in Sweden, allowing users to make payments using their bank account. Payments are authorised quickly and easily within the user’s Swish mobile application, providing a hassle-free and secure payment experience.

Some of the main benefits of offering Swish as a payment method are:

- Ease of use: Simple and fast checkout for Swedish citizens

- High market penetration: 86% of the Swedish population uses Swish

- Enhanced security: authentication is handled by the BankID app

User Experience

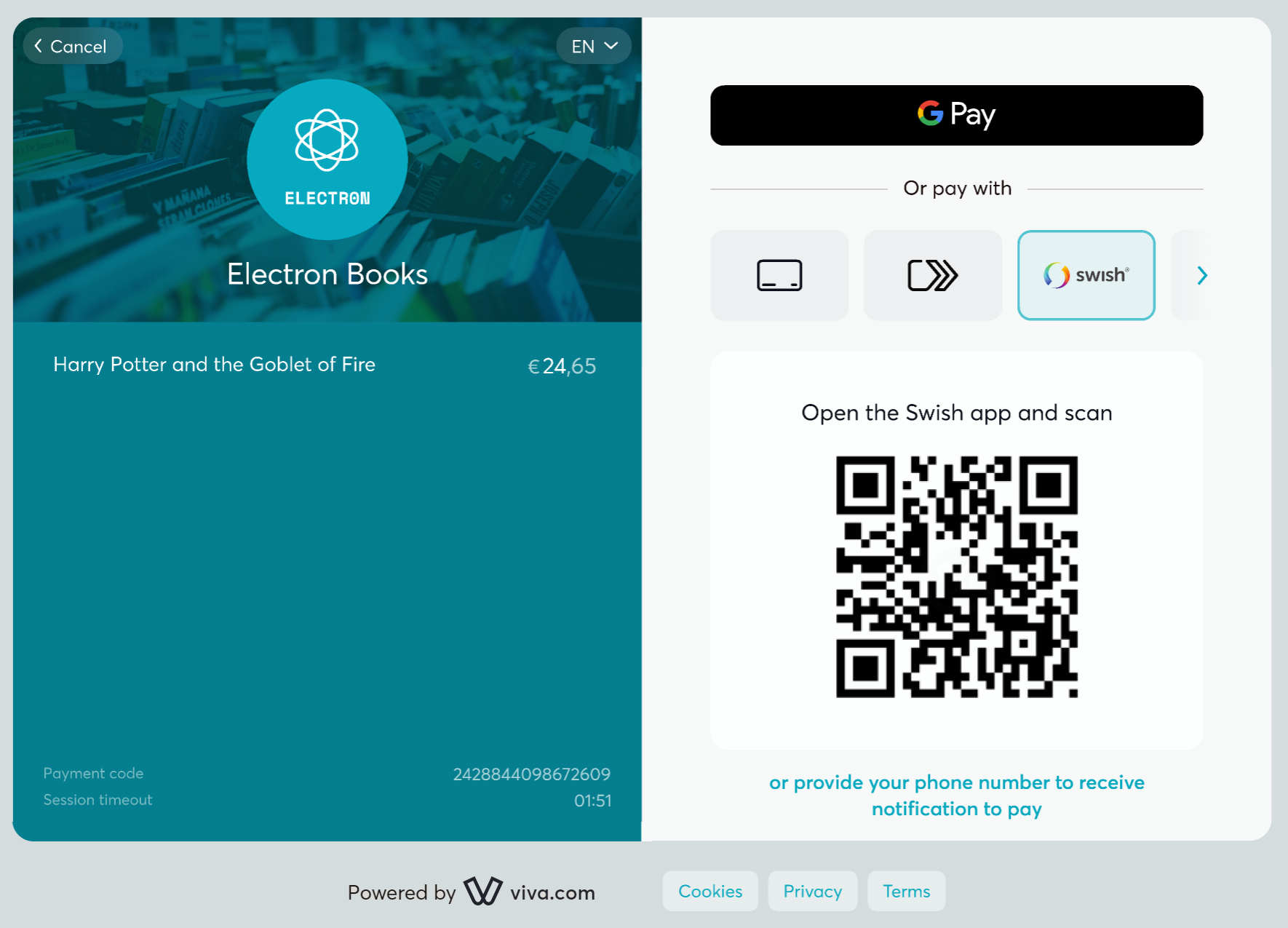

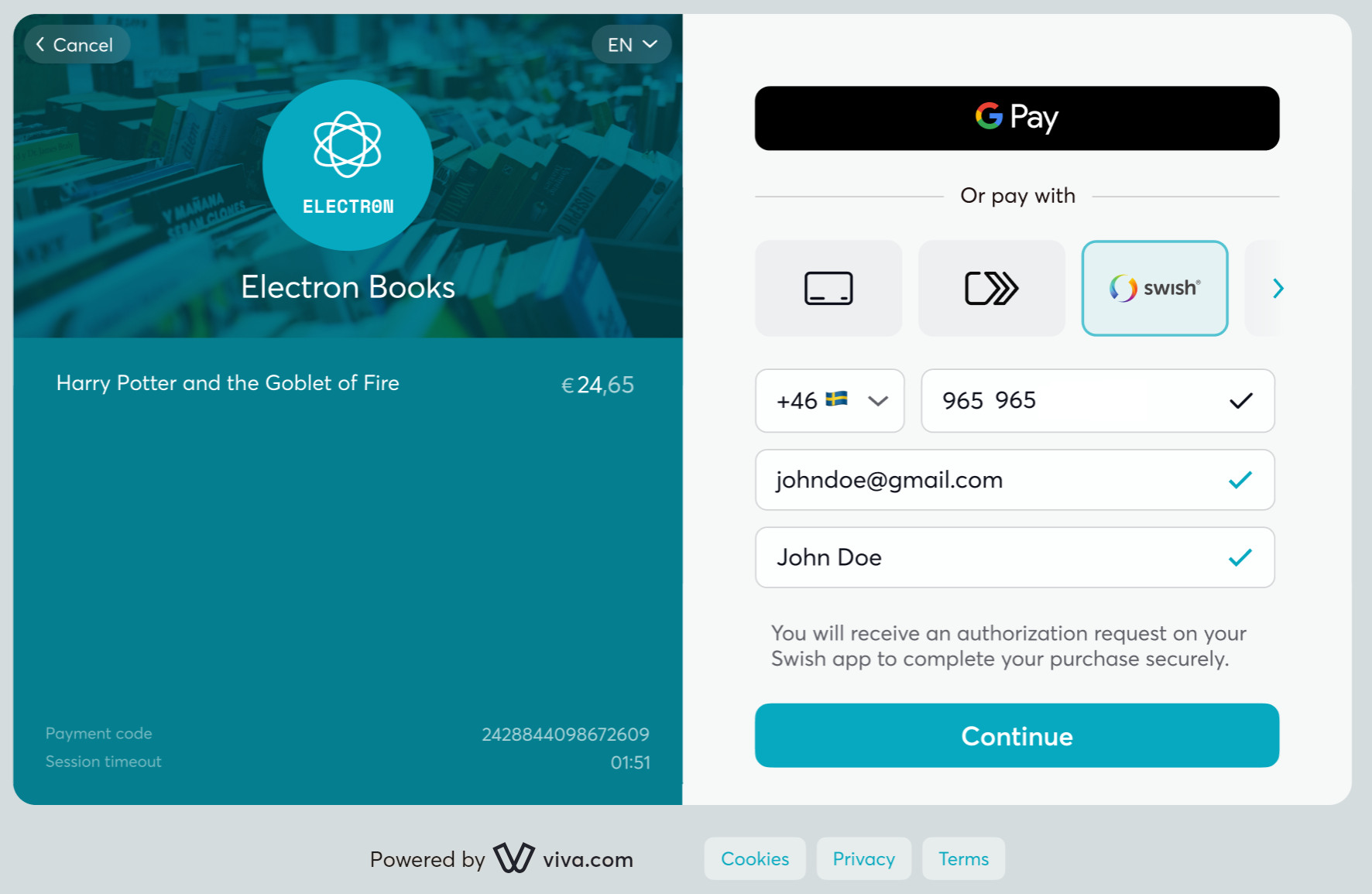

On Desktop:

1. At the online checkout, the customer chooses either to:

(a) Open the Swish app on their mobile device and scan the QR code

(b) Provide their mobile phone number to receive a prompt on their mobile device to open the Swish app

|

|

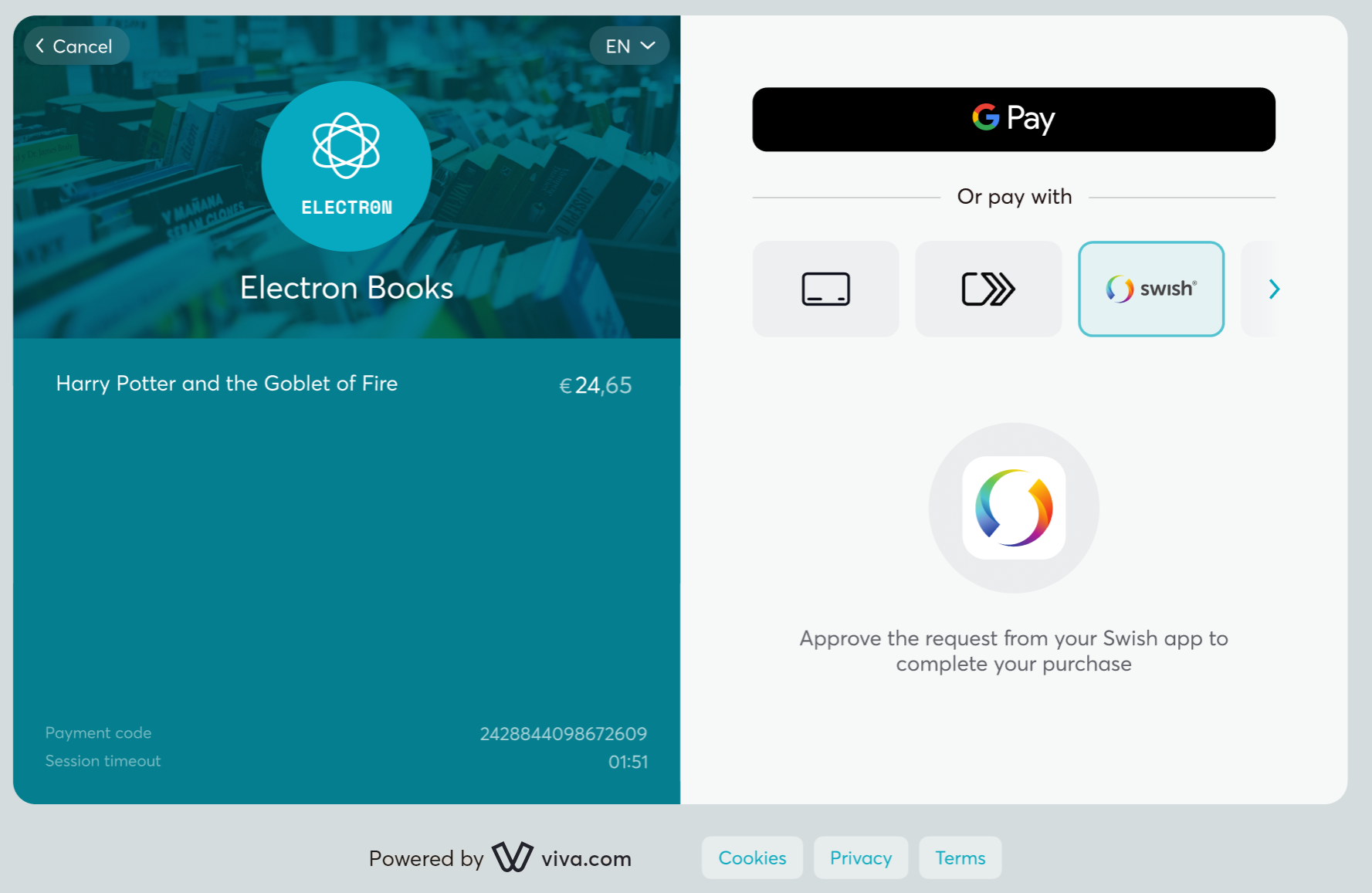

2. The checkout page waits for the customer to authorise the payment within their Swish app:

3. Once authorised, the customer is then authenticated via their BankID app

4. The payment result is then displayed (success or failure)

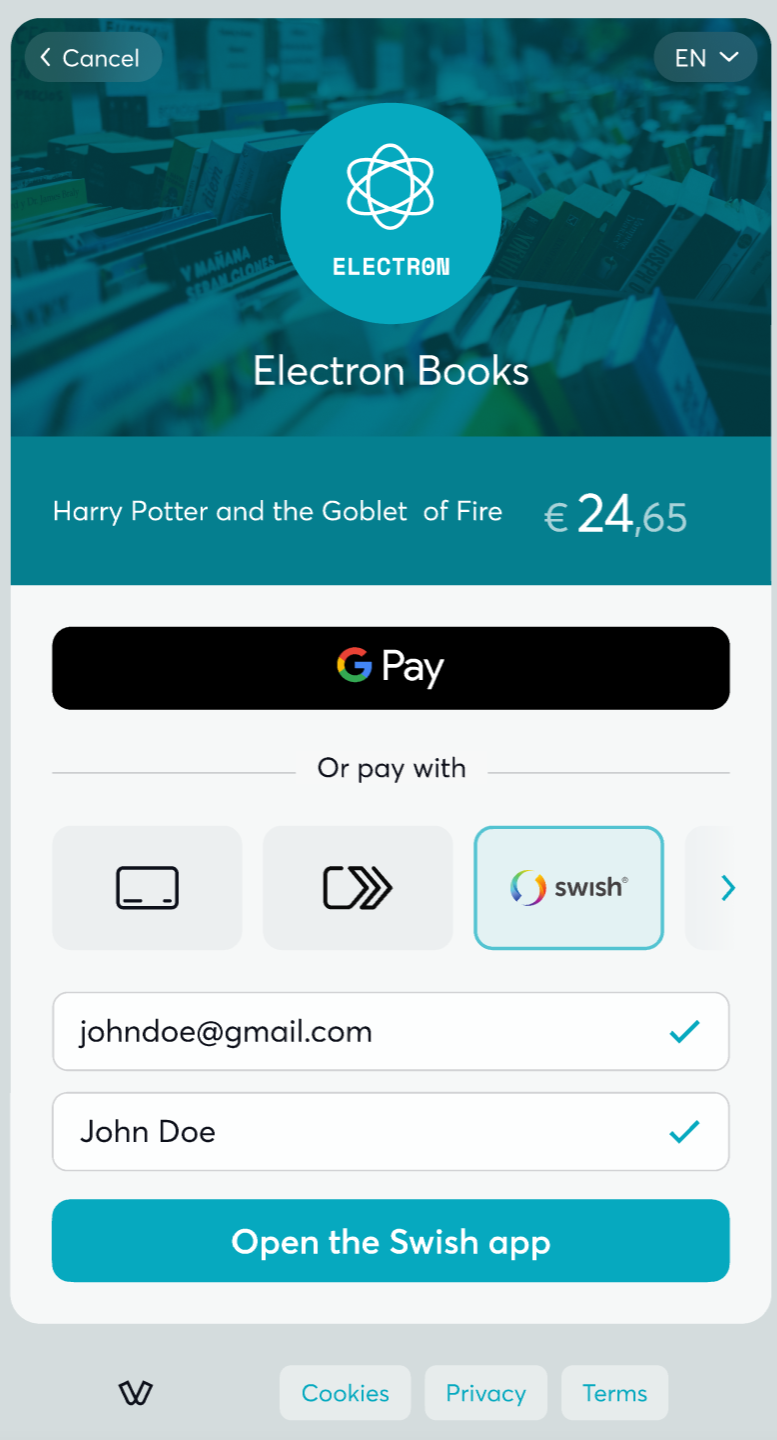

On Mobile:

1. At the online checkout, the customer enters their information and taps ‘Open the Swish app’ to launch the Swish app on their device:

2. The customer authorises the payment within their Swish app

3. Once authorised, the customer is then authenticated via their BankID app

4. The payment result is then displayed (success or failure)

Details

- How to activate: Please refer to the How to activate section below

- Payment method type: Synchronous - payments are confirmed immediately

- Refunds: Supports partial and full refunds

- Recurring payments: Not supported

- Pre-authorizations: Not supported

- Restricted MCC: All Merchant Categories are eligible to have Swish activated

- Μerchant countries: Sweden

- Customer countries: Sweden

- Pricing: Please refer to our pricing page under the main navigation for more information.

- Settlement: Customer payments via Swish will be deposited to the merchant’s bank account (not their Viva account)

- Cross-currency payments: Not supported

- Additional notes: Swish is available through Quick Pay, for payment orders with the

disableExactAmountparameter set to ‘true’ and through Payment Notifications - ISV: Supports ISV Program

How to activate Swish

Merchants need to have a Swish-supporting Swedish bank account

| Environment | Activation details |

|---|---|

| Production | The Swish activation process is initiated by the merchant, as outlined below |

| Demo | Swish is not available in the Demo environment |

Activation of the Swish payment method is initiated by the Merchant. Viva is then informed for the merchant’s readiness by Swish. Please see the process below:

The merchant informs their Swedish Bank of choice that they want to enable the payment method: ‘Swish Handel’ with technical supplier: ‘viva.com’

An agreement will be signed between the merchant and the merchant’s bank

The merchant’s bank will then contact Swish to continue the process on their side

Upon conclusion, a mail will be sent to Viva from Swish, to inform about the merchant’s readiness and any necessary information

Viva will then activate the payment method for the merchant

Payment method messaging

It is important that the customer is aware of the payment methods you offer via Smart Checkout, as this will increase conversion and average order values. Please see our payment method messaging guide for more details on why and where we would recommend adding this information to your site.

If desired, you can download and use this icon on your site or online store, in order to show customers you offer Swish as a payment method:

Get Support

If you would like to integrate with Viva, or if you have any queries about our products and solutions, please see our Contact & Support page to see how we can help!