Payconiq

⚠️ Important Notice: Payconiq Deprecation

Payconiq will terminate its services on 4 December 2025.

For Viva, support for Payconiq will end earlier, on 27 November 2025.After 27 November 2025, Payconiq will no longer be supported in any Viva products, integrations, or APIs.

Please make sure that any Payconiq-related functionality is removed or replaced before this date to avoid service disruptions.

Information on the Payconiq payment method for online payments.

We also offer Payconiq for in-store payments (via QR code)

- Introduction

- User Experience

- Details

- How to activate Payconiq

- Merchant Categories

- Supported Apps

- Testing Payconiq

- Payment method messaging

- Get Support

Introduction

The Payconiq platform connects banks, merchants, payment service providers and consumers, to allow omni-channel payments online, in store, by invoice or peer-to-peer. It is an API-based platform, allowing for a fast connection and value-added services.

Consumers can download one of the stand-alone apps or use the Payconiq integration in their mobile banking apps (where available), according to their country of residence. They connect their bank account to the app and then are able to make payments to affiliated merchants by scanning a QR-code, or to friends (by e-mail address or cellphone number).

Some of the main benefits of offering Payconiq as a payment method are:

- Ease of use: Customers experience a simple and seamless experience

- Security: Payments are completed safely within the customers’ Payconiq or banking apps

- Get started quickly: There is no need for the merchant to have an account with Payconiq

User Experience

Screenshots

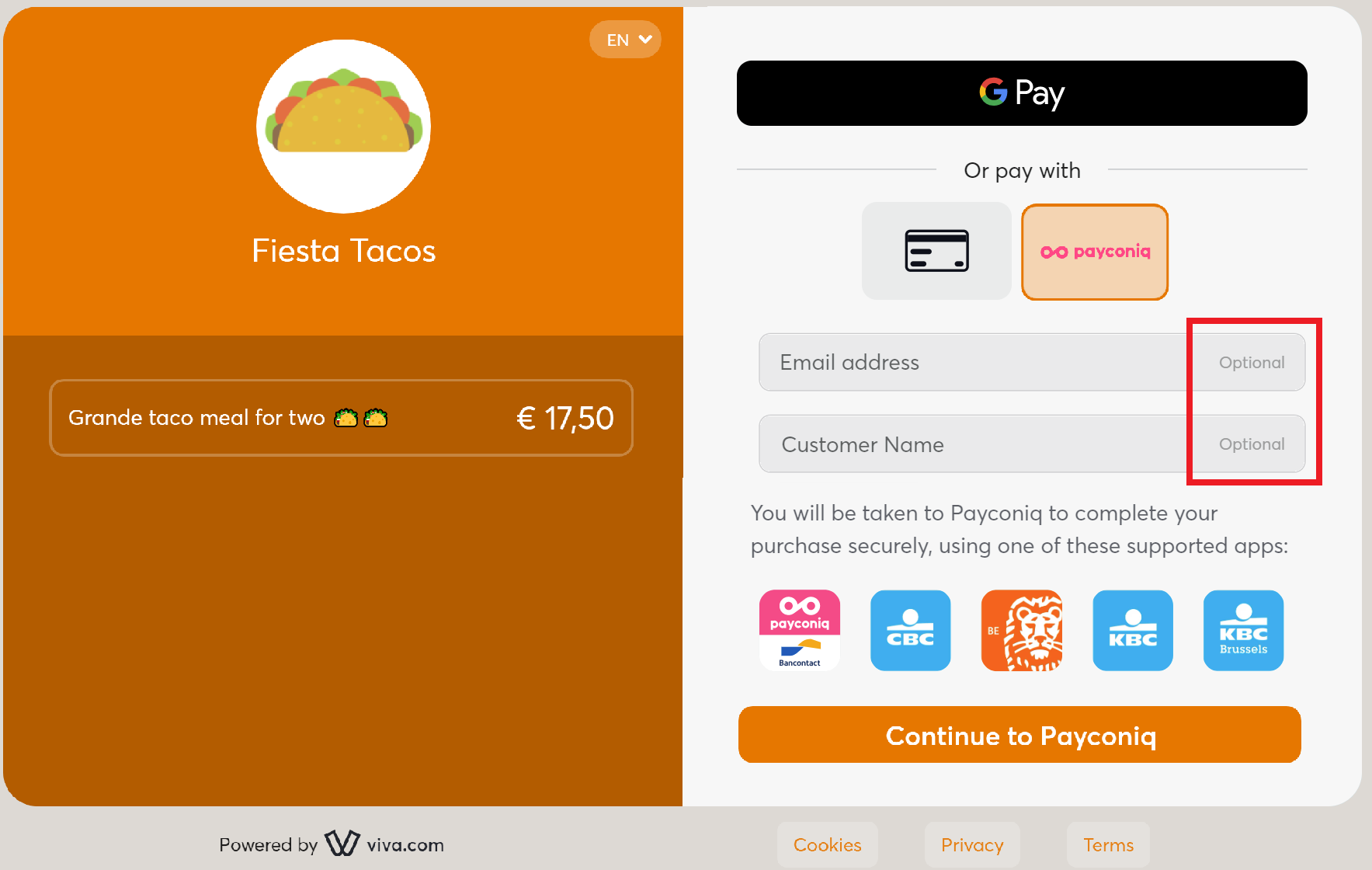

At the checkout, the customer chooses Payconiq as their preferred payment method, optionally filling in the Email address and Customer Name. The customer can see the supported apps and then proceed to Payconiq:

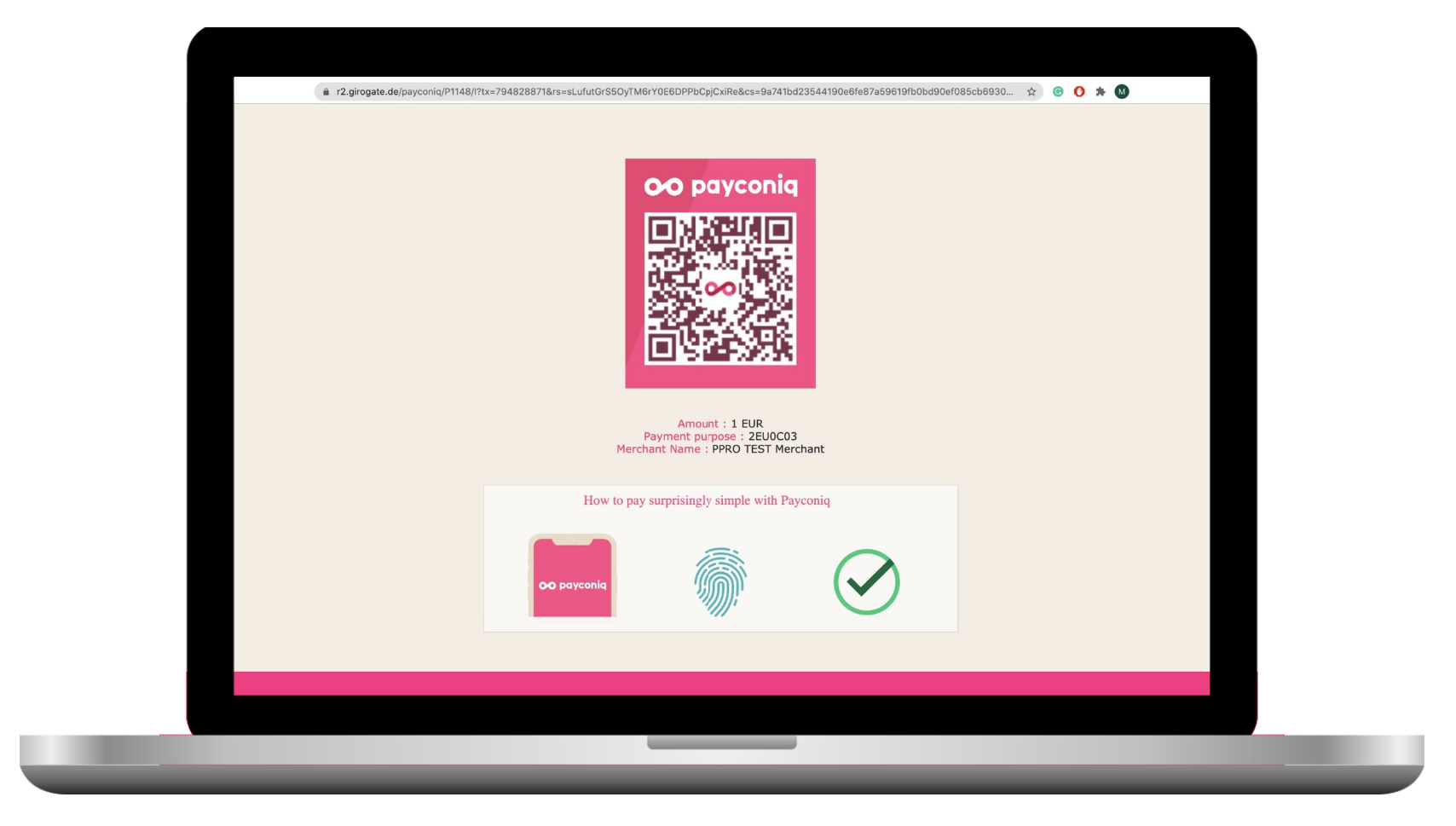

A Payconiq QR code is generated, and the consumer is presented with instructions for how to complete the payment:

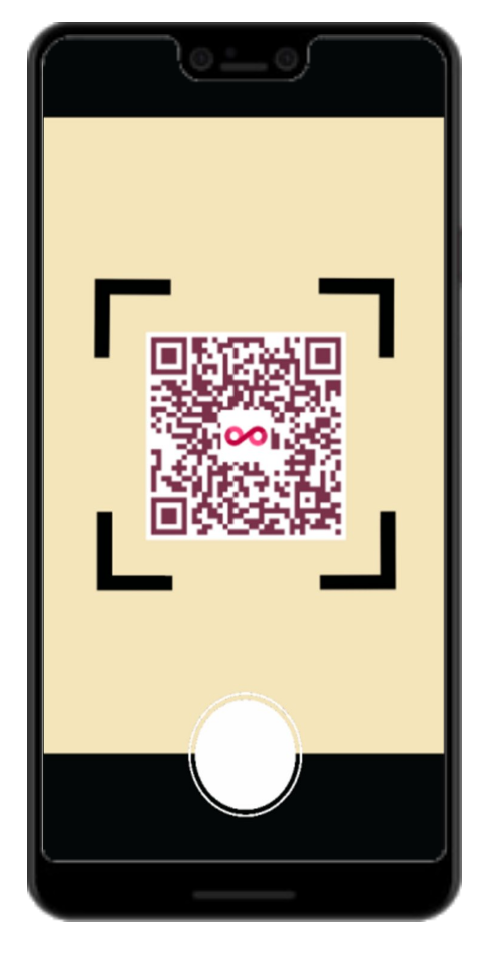

Once the QR code has been scanned, the Payconiq mobile app will continue with the payment in the app:

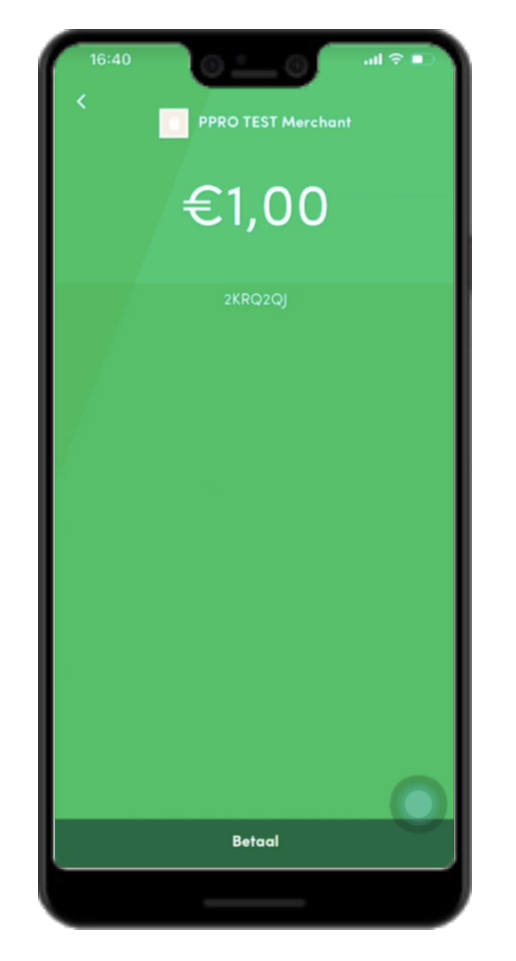

The consumer reviews the merchant details, order reference and payment amount before continuing:

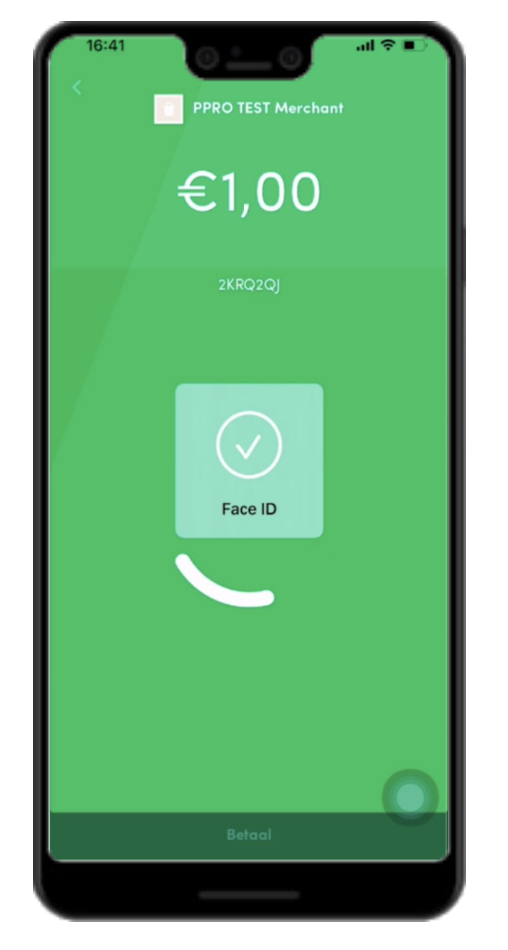

The consumer verifies their identity to confirm the transaction:

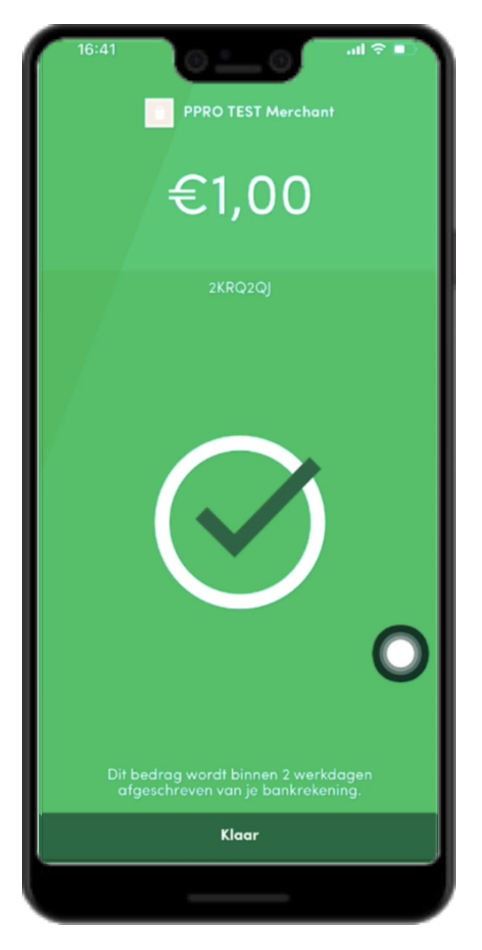

The merchant will be notified of the successful transaction immediately afterwards:

Videos

Please also see our videos below, outlining the desktop and mobile use of Payconiq:

Desktop:

Mobile:

Details

Merchants do not need to have an account with Payconiq

- How to activate: Please refer to the How to activate section below

- Payment method type: Asynchronous - payments are not confirmed immediately, it may take up to 20 minutes to receive confirmation of payment. You need to set up webhooks in order to get notified for asynchronous payments

- Refunds: Supports partial and full refunds

- Recurring payments: Not yet supported

- Pre-authorizations: Not yet supported

- Restricted MCC: Some Merchant Categories are not eligible to have Payconiq activated

- Μerchant countries: Available for merchants registered in Austria, Belgium, Cyprus, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Malta, Netherlands, Portugal & Spain

- Customer countries: Available to customers in Belgium & Luxembourg only

- Pricing: Please refer to our pricing page under the main navigation for more information

- Settlement: Customer payments are deposited next day into your business account for confirmed payments / successful transactions (i.e. have statusId = F)

- Cross-currency payments: Not yet supported

- Additional notes: Payconiq is not available through Quick Pay or for payment orders with the

disableExactAmountparameter set to ‘true’. The Email address and Customer Name fields within Smart Checkout are optional - ISV: Supports ISV Program

How to activate Payconiq

Merchants do not need to have an account with Payconiq

| Environment | Activation details |

|---|---|

| Production | All merchants are activated by default to accept payments for Payconiq, with the exception of certain Merchant Categories. *You may visit our Test Cards and Environments page for further information on how to make test payments with Payconiq. |

| Demo |

Merchant Categories

There are some merchant categories that are not eligible to have Payconiq activated. If your business is in one of these categories, you will not be able to accept payments through Payconiq:

| Merchant Category (MCC) | Description |

|---|---|

| 6010 | Member Financial Institution–Manual Cash Disbursements |

| 6011 | Member Financial Institution–Automated Cash Disbursements |

| 6051 | Quasi Cash–Merchant |

| 7273 | Dating Services |

| 7297 | Massage Parlors |

| 7393 | Detective Agencies, Protective Agencies, Security Services including Armored Cars, Guard Dogs |

| 9223 | Bail and Bond Payments |

Supported Apps

A customer from Belgium may scan the Payconiq QR code and pay with these apps:

A customer from Luxembourg may scan the Payconiq QR code and pay with these apps:

Testing Payconiq

In order to test Payconiq functionality in the demo environment, please see our Payconiq testing information.

Payment method messaging

It is important that the customer is aware of the payment methods you offer via Smart Checkout, as this will increase conversion and average order values. Please see our payment method messaging guide for more details on why and where we would recommend adding this information to your site.

If desired, you can download and use this icon on your site or online store, in order to show customers you offer Payconiq as a payment method:

Get Support

If you would like to integrate with Viva, or if you have any queries about our products and solutions, please see our Contact & Support page to see how we can help!