Test cards and environments

Validate your integrations by making test payments via various methods and with differing outcomes.

Test cards

When testing our Smart Checkout or any of our plugins in the sandbox/demo environment, enter any of the below in place of real card details.

Webhook notifications will not be triggered for expired payment orders, cancelled transactions, or payments that failed 3DS user authentication (see the Event ID codes). If you wish to test a Transaction Failed webhook, please use our trigger a decline section

| Card number | Card scheme | Card icon | CVV | Expiry (mm/yy) | Transaction response |

|---|---|---|---|---|---|

| 4147 4630 1111 0133 | Visa | Any 3 digits | Any future date | ✔️ Successful | |

| 4147 4630 1111 0141 | Visa | Any 3 digits | Any future date | ❌ Failed | |

| 5239 2907 0000 0101 | Mastercard | Any 3 digits | Any future date | ✔️ Successful | |

| 5239 2907 0000 0119 | Mastercard | Any 3 digits | Any future date | ❌ Failed | |

| 3762 060000 00009 | American Express | Any 4 digits | Any future date | ✔️ Successful | |

| 3762 0600 0000 025 | American Express | Any 4 digits | Any future date | ❌ Failed | |

| 6759 6498 2643 8453 | Maestro | Any 3 digits | Any future date | ✔️ Successful | |

| 5012 8899 1154 1119 | Maestro | Any 3 digits | Any future date | ❌ Failed | |

| 6060 0500 0000 00130 | Bancontact | N/A | Any future date | ✔️ Successful | |

| 6060 0500 0000 00148 | Bancontact | N/A | Any future date | ❌ Failed | |

| 3569 9900 1229 9011 | JCB | Any 3 digits | Any future date | ✔️ Successful 1 | |

| 3528 1111 1111 11119 | JCB | Any 3 digits | Any future date | ❌ Failed | |

| 6011 0009 9013 9424 | Discover | Any 3 digits | Any future date | ✔️ Successful | |

| 6011 5000 0011 0166 | Discover | Any 3 digits | Any future date | ❌ Failed | |

| 3607 050010 0111 | Diners | Any 3 digits | Any future date | ✔️ Successful | |

| 3613 960000 0008 | Diners | Any 3 digits | Any future date | ❌ Failed | |

| 4000 0025 0000 1126 | Cartes Bancaires | Any 3 digits | Any future date | ✔️ Successful | |

| 4000 0025 0000 1118 | Cartes Bancaires | Any 3 digits | Any future date | ❌ Failed |

1 Applies to Greek merchants only.

Some test cards may result in an error for the below merchant categories, due to account restrictions:

- 5967: Direct Marketing – Inbound Teleservices Merchant

- 6051: Non-Financial Institutions – Foreign Currency, Money Orders (not wire transfer) and Travellers’ Cheques

- 7995: Betting (including Lottery Tickets, Casino Gaming Chips, Off-track Betting and Wagers at Race Tracks)

Trigger a decline

You can simulate declines by creating payment orders with specific amounts and attempting payment using the test cards listed below:

| Card number | Card scheme | Card icon | CVV | Expiry (mm/yy) |

|---|---|---|---|---|

| 4147 4630 1111 0133 | Visa | Any 3 digits | Any future date | |

| 5188 3400 0000 0060 | Mastercard | Any 3 digits | Any future date | |

| 5239 2907 0000 0101 | Mastercard | Any 3 digits | Any future date |

For ease of testing, we have created a sample Smart Checkout page, in which you can enter any desired amount to pay

There are two types of declines you can test:

An issuer decline without decline recovery

This will trigger a decline from the card’s issuer, simulating an expired card, for example. The user will then be redirected to the payment failure URL.

| Payment amount | Response EventId | Response description |

|---|---|---|

| €99.06 or €9906 | 10006 | General error - The card issuer has declined the transaction as there is a problem with the card |

| €99.07 or €9907 | 10007 | Pick up card, special condition (fraud account) - This usually means the customer’s bank has stopped the transaction because the card has been marked as fraudulent |

| €99.14 or €9914 | 10014 | Invalid card number - The card issuer has declined the transaction as the credit card number is incorrectly entered or does not exist |

| €99.41 or €9941 | 10041 | Lost card - The card issuer has declined the transaction as the card has been reported lost |

| €99.54 or €9954 | 10054 | Expired card - The payment gateway declined the transaction because the expiration date is expired or does not match |

| €99.70 or €9970 | 10070 | Call issuer - The card owner should contact card issuer |

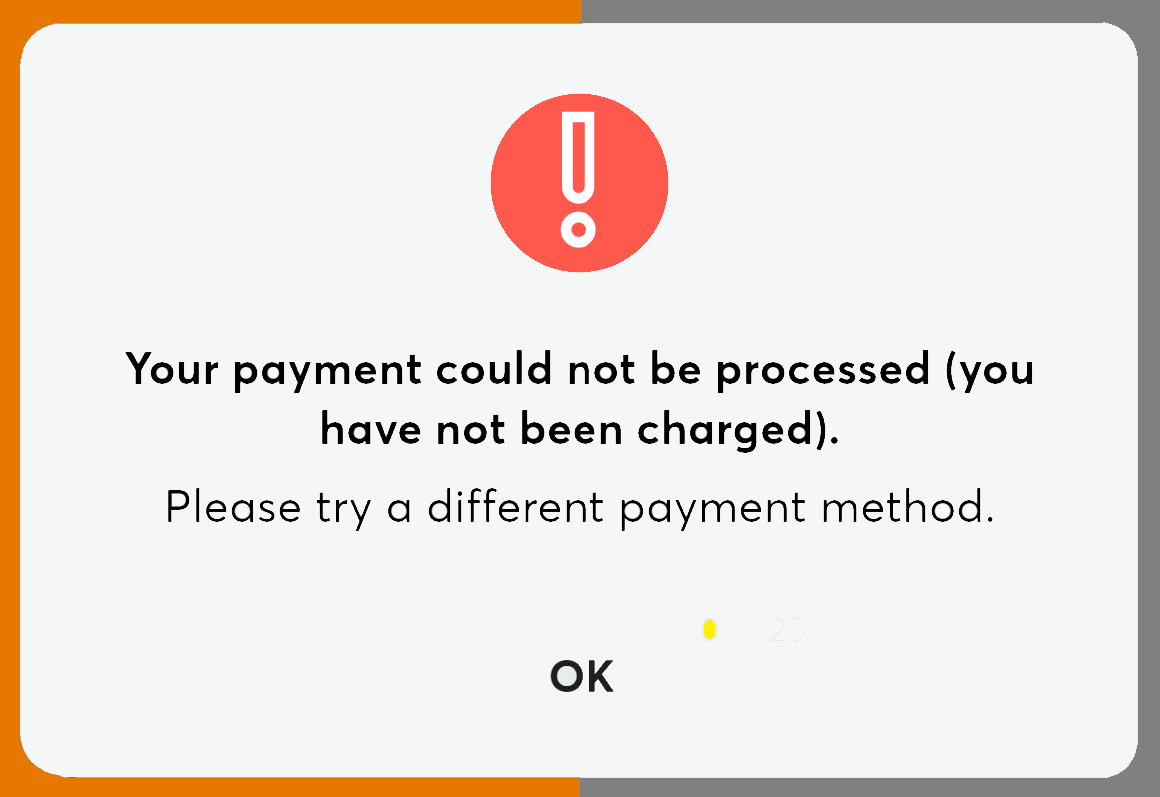

An issuer decline with decline recovery

This will trigger Smart Checkout’s decline recovery functionality, allowing the user to retry the payment. When triggered, the decline recovery pop-up (as shown below) will appear:

There are several different events which will lead to the decline recovery functionality being triggered:

| Payment amount | Response EventId | Response description |

|---|---|---|

| €99.05 or €9905 | 10005 | Do not honor - the issuing bank declined the transaction without an explanation |

| €99.20 or €9920 | 10200 | Generic error - a temporary error occurred during the transaction |

| €99.51 or €9951 | 10051 | Insufficient funds - the card has insufficient funds to cover the cost of the transaction |

| €99.57 or €9957 | 10057 | Function not permitted to cardholder - the card issuer has declined the transaction as the credit card cannot be used for this type of transaction |

| €99.61 or €9961 | 10061 | Withdrawal limit exceeded - exceeds withdrawal amount limit |

| €99.79 | 10079 | Life Cycle - the transaction is refused due to invalid card data. |

| €99.96 | 10096 | System malfunction - a temporary error occurred during the transaction |

Card installments

Use the below test cards to pay in card installments.

Card installments apply only to Greek merchants

| Card number | Card scheme | Card icon | CVV | Expiry (mm/yy) |

|---|---|---|---|---|

| 5188 3400 0000 0060 | Mastercard | Any 3 digits | Any future date | |

| 5239 2907 0000 0101 | Mastercard | Any 3 digits | Any future date | |

| 5239 2907 0000 0119 | Mastercard | Any 3 digits | Any future date |

Please note: If offering installments, the value provided by the merchant is not the number of installments the customer will select, and it is not mandatory for the customer to select installments at all. The process is as follows:

- The merchant indicates the maximum number of installments they wish to offer to the customer

- It is then up to the customer whether they pay with or without installments

- If the customer decides to pay with installments, they are able to select the number of installments (up to the maximum specified by the merchant)

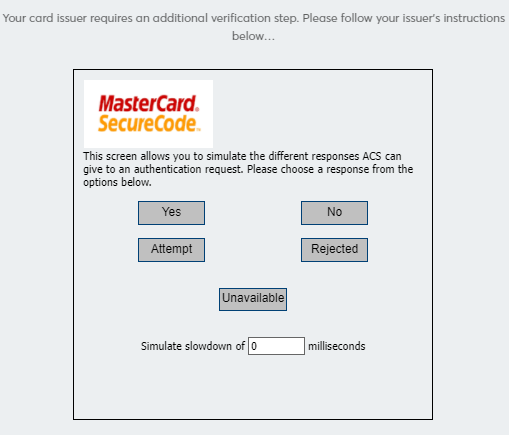

3DS challenge flow

If you want to simulate the 3DS challenge that a customer will see, use one of the below test card numbers.

| Card number | Card scheme | Card icon | CVV | Expiry (mm/yy) |

|---|---|---|---|---|

| 5188 3400 0000 0060 | Mastercard | Any 3 digits | Any future date |

When using these cards, the following pop-up will be displayed:

You can then select one of the 5 below options to simulate the relevant response:

- Yes [Y] = Authentication Successful

- No [N] = Not authenticated

- Attempt [A] = Attempted to authenticate

- Rejected [R] = Authentication Rejected

- Unavailable [U] = Authentication could not be performed

Digital wallets

The testing process may differ for each digital wallet. Please see below for further information.

Apple Pay

To test Apple Pay in the Demo environment, you will need to utilise the Apple Pay Sandbox

The test cards and more can be found within Apple’s documentation, linked above.

If you wish to activate Apple Pay on demo environment, please contact your Viva sales representative.

Google Pay

There are two options to test Google Pay:

- Log in to a Google account and create a Google Pay wallet with valid card details

- Use a sample card from Google’s test card suite

Samsung Pay

For Information on Samsung Pay testing, please navigate to Getting Started > Create Services within the Samsung Pay Developers website .

Viva Wallet

You can use your demo Viva account to make test payments in our sandbox environment.

Local payment methods

The testing process may differ for each local payment method. Please see below for further information.

Klarna

If you wish to test Klarna on the Demo environment, please contact your Viva sales representative.

Once activated, you can make a live test directly on Smart Checkout. You should use the below card for testing Klarna:

- Credit Number: 4111 1111 1111 1111

- CVC: 123

Expiration date: Any future date in MM/YY format <!–

Payconiq

All tests and integrations are carried out in Payconiq’s External Environment. To perform test transactions and to validate the integration end-to-end, you need to download the test Payconiq App for Android or iOS.

Payconiq will provide more guidelines for testing. For more information, please navigate to Getting Started > Environments on the Payconiq Development Portal . –>

Bancontact QR

It is currently not possible to test Bancontact QR on the Demo environment.

Other local payment methods

If you wish to test acceptance of payments online for the other local payment methods, contact your Viva sales representative to get them activated on your demo Viva account. Once you have the required payment method(s) activated, you will be able to select these via our Smart Checkout.

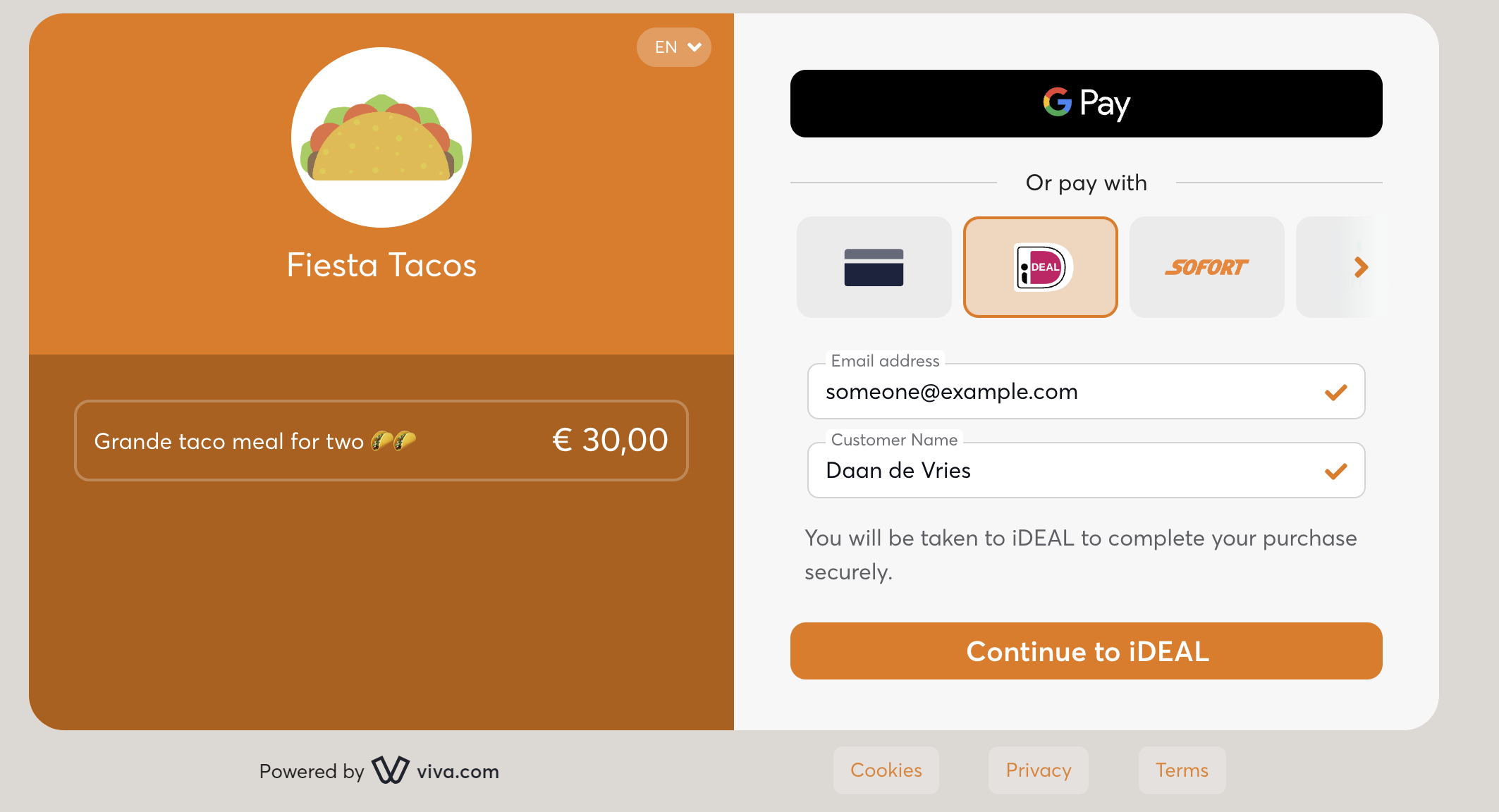

To perform a test payment, do the following:

Select the desired payment method, complete all required information and continue to the next step:

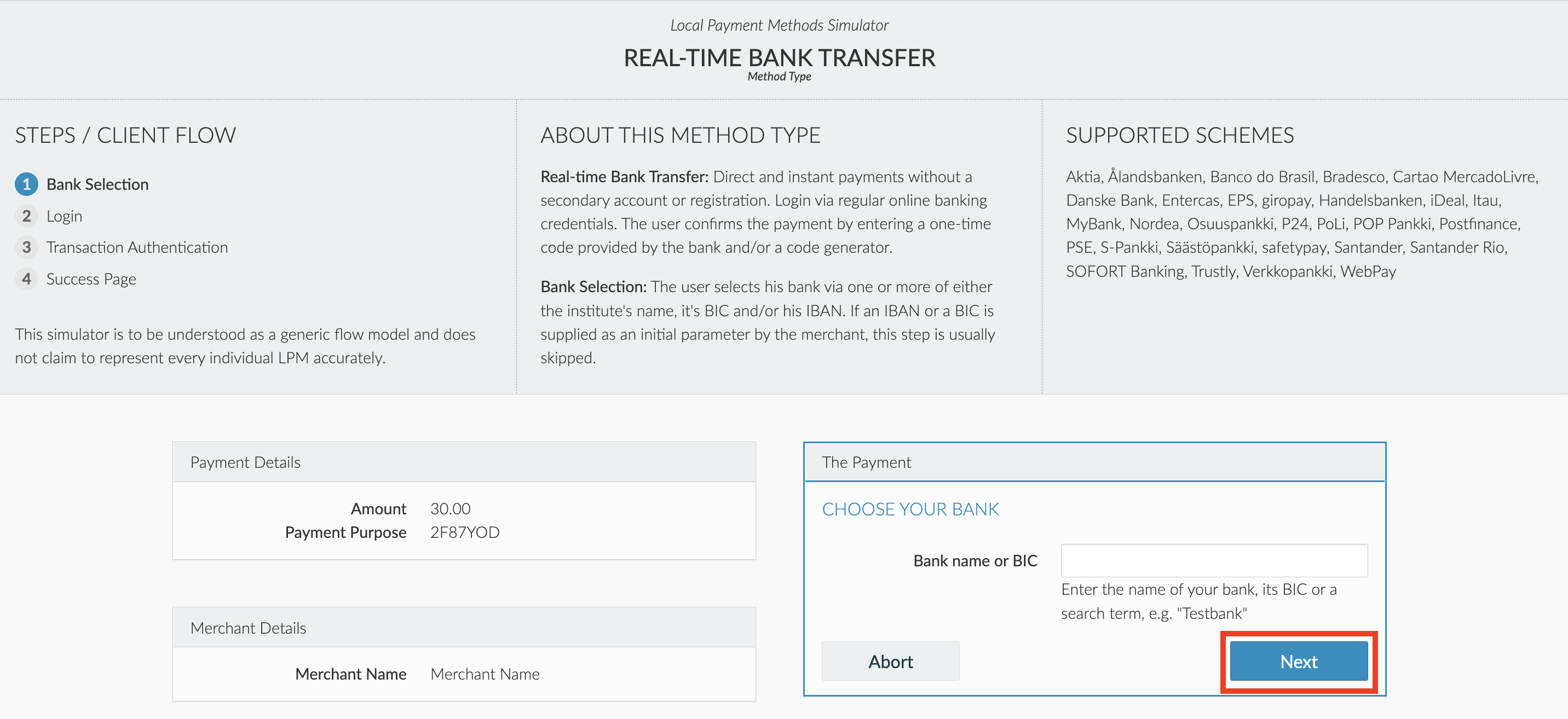

In this example (for the iDEAL payment method), the Local Payment Methods Simulator will then be displayed

Leave the Bank name or BIC field blank and click on the Next button:

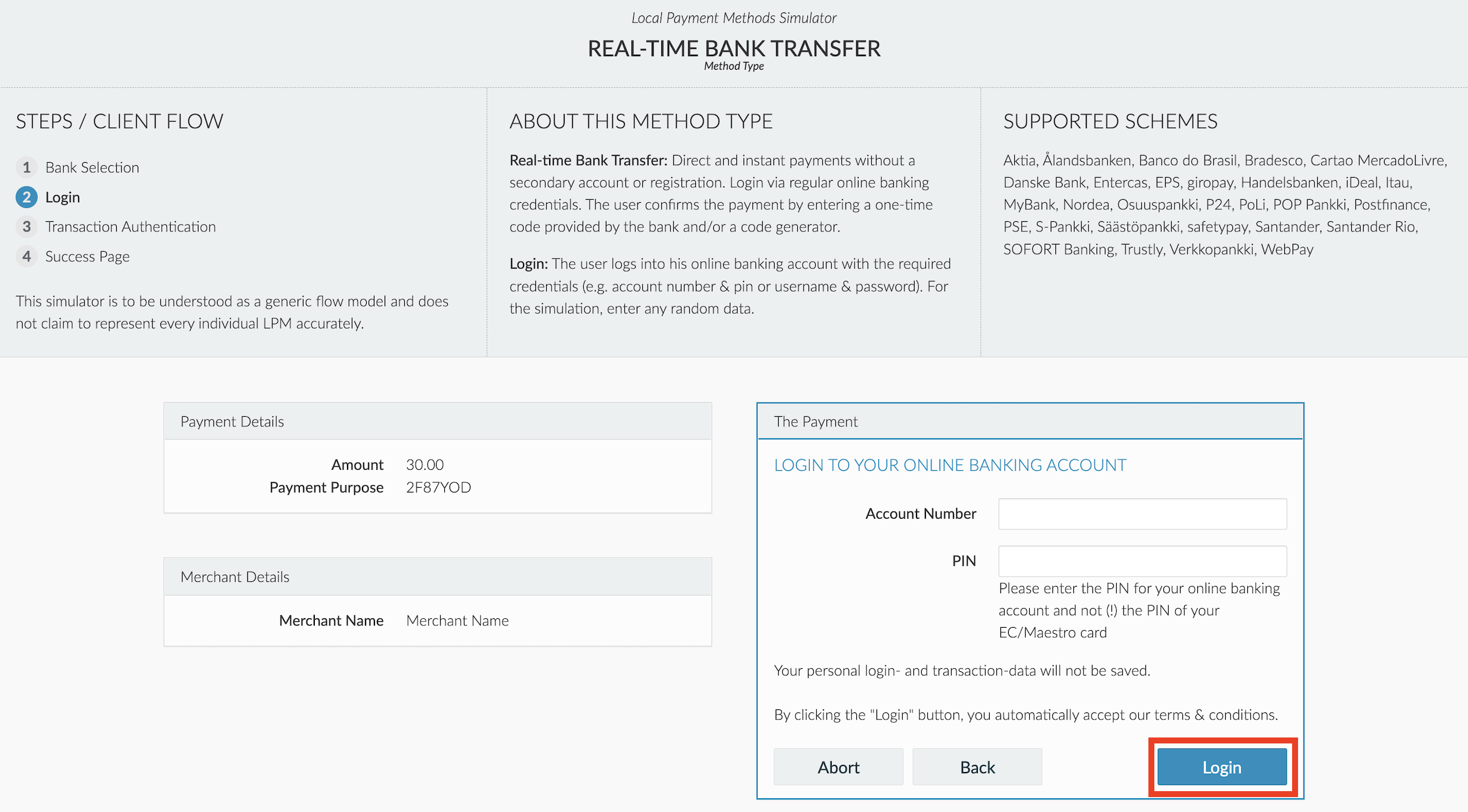

Leave the Account Number and PIN fields blank and click on the Login button:

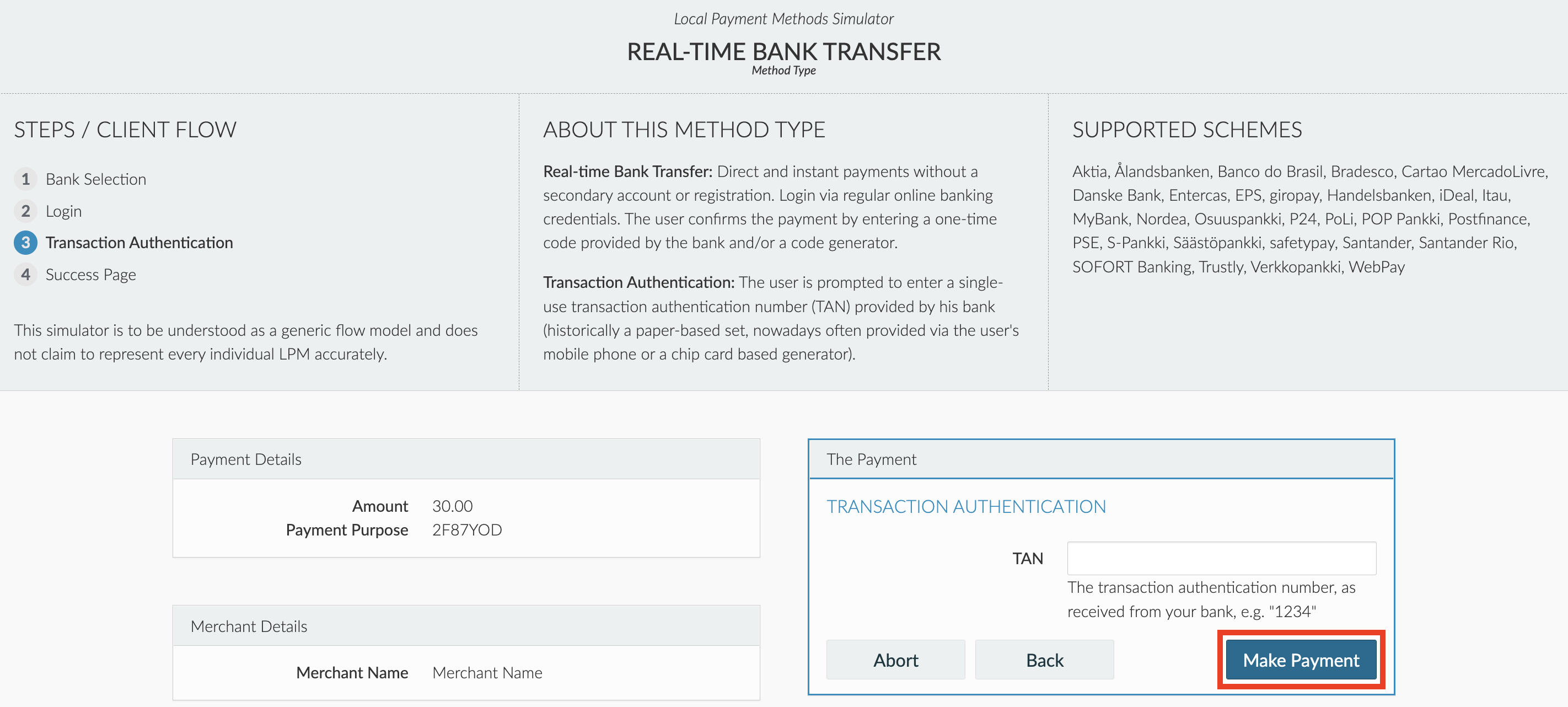

Leave the TAN field blank and click on the Make Payment button:

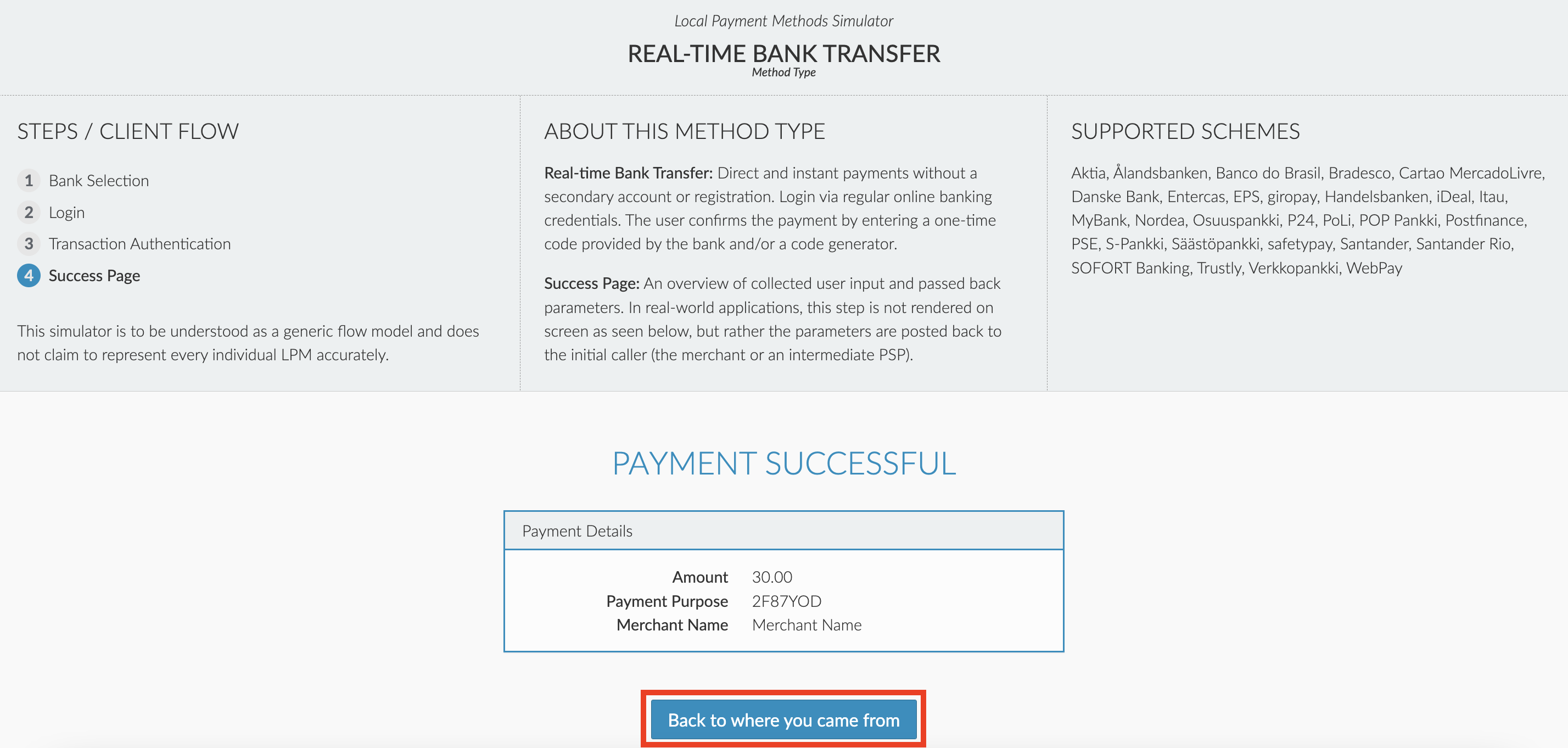

Click on the Back to where you came from button:

A confirmation page will be displayed showing a successful order against the local payment method selected

It is currently not possible to test IRIS and tbi bank on demo environment.

Direct Debit & other

Except Pay On Delivery, Direct Debit & other payment methods are currently unavailable on demo environment.

Pay On Delivery

To perform a test transaction, simply fill the input fields and click Order button.

Get Support

If you would like to integrate with Viva, or if you have any queries about our products and solutions, please see our Contact & Support page to see how we can help!